Just my luck that last night just as I pushed the Publish button, I received a copy of Foreign Exchange Agreement #33, regulating the new “market”, different than the Cencoex Bs. 6.3 per US$ system and the Bs. 12+ Sicad system. Then this afternoon I received the regulations for the securities part of SIMADI. In some sense, it is good that it happened this way, otherwise lst night’s post may have been too long, complex and boring.

To give you my punchline right away: SIMADI may be a system, but a market, it ain’t.

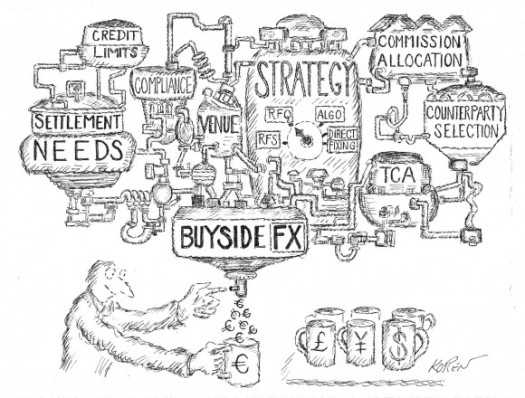

In fact, it an extraordinarily complex and bizarre system for buying and selling currency. It even makes you wonder why it is that way…

SIMADI has three parts:

1) The cash retail system

2) The bank cash system

3) The bank and broker securities system

Let’s look at each of them:

1) The cash retail system

This market called “menudeo” will function via foreign exchange houses and banks and be devoted only to individuals. Minimum is US$ 300 and it will be limited to US$ 300 per day, US$ 2,000 per month and US$ 10,000 per year for each individual,

How does it work? You go to your bank or exchange house and buy or sell dollars at yesterday’s exchange rate for the system. This will also be (yesterday’s rate) the referential rate for credit card transactions and custom duties.

2) The cash bank system

This is likely the weirdest one. Minimum is US$ 3,000. You also buy at yesterday’s rate, however, each bank can only buy and sell foreign currency with its own clients. That is, there is no interbank system or market. You buy and sell only with the clients of your bank and at yesterday’s price. To make it even weirder, banks can not hold positions. That is they can not buy dollars for their own account in this system, only by buying (selling) cash from clients and selling (buying) cash to other ones. If they buy too much on a given day, they have to sell any excess foreign currency to the Venezuelan Central Bank. Oh yeah! If you are a client and want to do either, you have to send the bank either the Bolívars or the US$ to the bank ahead of time. Only if they are there is the bank allowed to do the transaction.

3) The securities system

The securities system will operate in the Bolivarian Stock Exchange, where all authorized brokers and banks can operate. They can buy or sell dollar denominated securities in exchange for Bolivars at an agreed rate.

However, they can not do transactions with anyone but their clients and other brokers and banks can not be your client. i.e. You have the sellers you can find buyers among your clients. That’s it. When you sell the bonds in US$, the dollars from the transaction have to go to your Venezuelan banking system dollar based account.

In this market, brokers and banks can take positions, i.e. they can buy, for example, dollars from a client, keep it and later sell it to another client, but not to another broker or bank.

Oh yeah! The Central Bank does have to approve the transactions you close.

Thus, this is no market. This is just a bizarre system. Why do you need to do this via an exchange is a mystery, except that the Government wants to keep tabs of transactions, but there are no bids or asks, the clients of your institution (to use the language of the regulations) agree on a price and you do the transaction at that price. But you don’t talk to other market players. You only look at previous transactions and try to have your clients agree on a price.

What does this mean?

-The price has a strange way of being constructed.

-There is no market per se

-If you are a bank or a broker, you can only sell however many dollars your own clients sell to you.

-I suspect that Government-owned banks will have a huge advantage as the Government, the largest generator, provider, holder of foreign currency, will likely give its own banks bonds or foreign currency to trade. They will have a gigantic advantage over private banks. Once again, leave the private sector out of it as much as possible, maybe the word “marginal” refers to the role of the private sector in all this.

-The parallel market still exists. Moreover, there will be arbitrage now not only between Cencoex and Sicad and the parallel rate, but there will also be arbitrage between SIMADI and the parallel rate. And a privileged few will make a lot of easy money.

-Market it is not, just a bizarre and complex system to exchange foreign currency.

Par for the course from Chavismo…

May 11, 2015 at 1:25 am

What i do not understood is in fact how you are

not actually a lot more well-preferred than you might be right now.

You’re so intelligent. You recognize thus significantly in relation to this subject, produced me for my part imagine it

from numerous various angles. Its like women and men don’t seem

to be fascinated until it is one thing to do with Lady gaga!

Your personal stuffs nice. At all times handle it up!

March 5, 2015 at 10:34 pm

[…] SIMADI May Be A System, But It Is Not A Market […]

February 19, 2015 at 8:15 pm

Ledezma!?

February 19, 2015 at 8:14 pm

Ledezma!???????

February 19, 2015 at 1:58 pm

Aside from the confirmation by Island Canuck on the rate for CC transactions, transfer websites like Western Union are already showing a Bs 169,90/US$ rate on their price estimator.

February 18, 2015 at 8:55 am

hi I didn’t realize I could use my us credit card here in shops is this true and has anyone been brave enough to try yet.thanks

February 18, 2015 at 10:33 am

A guy from Bloomberg tried and it worked, he was charged 170 per Us$

February 18, 2015 at 1:22 pm

I was going to try tomorrow when SIMADI opens again.

There was a guy on TripAdvisor who called VISA in Canada and was given a rate of around Bs.170 to US$1

February 18, 2015 at 5:14 pm

I can assure any of you living here that I just had a charge porocessed with a USA bank credit card at around Bs.170 to US$1.

Woopee!!

February 19, 2015 at 6:33 am

Incredible. That should help you guys in Margarita a bit.

February 17, 2015 at 11:06 pm

http://www.google.es/earth/

February 15, 2015 at 1:36 pm

The first question Ithink that eventually it will be the Simadi rate, but I would wait to make the trabsaction.

On the Bonos del Sur, I think it would be 6.3 until there is a transaction at Sicad (12), nothing leads me to think it will be at the Simadi rate, but it isundefined at this time.

February 15, 2015 at 12:28 pm

Miguel,

If a natural person living in the USA go to a bank (e.g., Wells Fargo) and ask to send a wire transfer into Bolivares to a Venezuelan Bank, what rate will it be at? – yesterday SIMADI’s rate? — If at SIMADI’s rate, will there be any limits?

Also, the other day you responded to me that expiring “Bonos del SUR” would be liquidated at 6.30. — Are you still sure on that? — Isn’t the 6.30 rate just for medicines and food? — If I am missing something so that 6.30 will apply to “Bonos del Sur,” could it be that this is part of the reason that they did not devalue the 6:30 rate? — If so, we may expect a devaluation of this rate once “Bonos del Sur” and the like are all expired. What do you think?

Thanks in advance!

February 15, 2015 at 5:21 am

Again my obsession with GDP per capita: any idea when the regime will publish their stats? I want to see what the PPP for Venezuela is supposed to be now.

February 14, 2015 at 4:49 pm

Mind experiment, put on your virtual goggles.

What would happen if suddenly the government went to 500 b. To the buck in the new third rate but provided the same number of dollars? Would the black market go to 550 in response?

February 16, 2015 at 4:21 pm

If the Gov’t suddenly took the exchange rate to 500 per US$, there would be no demand for a black market. In fact, some brave souls would likely start sending money into Vzla in order to buy assets that would now be dirt cheap(IF they could be bought in BsF, which is increasingly unlikely). Just my opinion!

February 14, 2015 at 6:16 am

Venezuelans are generally unaware of others than themselves and that is certainly the case for the widespread number of natives in this country. Call them what you want is the norm.

February 14, 2015 at 4:24 am

Do Indios in South America get pissed off when you call them Indios, like Native Americans in the states get pissed off when you call them Indians?

(Sometimes I go OT without any warning.)

February 15, 2015 at 6:49 pm

It’s polite to find their tribal background and refer to it, as in “Ernesto es Wayú”. But we all know pale skins are not very diplomatic.

February 15, 2015 at 7:52 pm

But if you’re talking about all Indigenous, is the word “Indios” often used like we stupidly use “Indians?”

February 16, 2015 at 12:48 am

All of the Indians I know or have known in the USA refer to themselves as Indians. The main national newspaper that one sees in the reservation stores is called Indian Country.

February 13, 2015 at 8:34 pm

Oh and another question: how ’bout entities? Can they buy as much currency as they wish and on any given day?

If so, the wise folks of 2010-2012 and SITME could go and set up all sorts of co’s to get the “cheaper” dollars (if you dare call 180/$ cheaper) and sell it through the “unmentionable” market. You think it won’t happen?

February 13, 2015 at 8:50 pm

Can they buy as much? I dont think there will be as much to buy and the price will go up unless the Government does not want it to go up. And of course there will be arbitrage, that is why the rukes are the way they are, new guiso

February 13, 2015 at 8:28 pm

What about sellers and the illicit exchange laws? Can a chocolate exporter – to name an example – reach this market and sell all their proceedings from exports?

When the permuta existed back in 2010, companies could not sell dollars legally unless they went to the permuta and many deemed that market illegal.

February 13, 2015 at 8:49 pm

They can sell at 170 or in the black on

February 13, 2015 at 6:06 pm

I think you are worry too much; it is very simple: 1CUC=25 pesos=1US$, ratio 1:25. 6.3VBF CENCOEX= 170VBF “Convertibles”=1US$, ratio 1:27. Conclusion welcome to Venecuba o Cubazuela.

February 13, 2015 at 3:25 pm

A brobdingnagian financial Rube Goldberg machine bond to fail.

February 13, 2015 at 12:34 pm

David Morán @morandavid 6h6 hours ago

Extraoficial: 9% la inflación de enero

February 13, 2015 at 11:08 am

The Venezuelan government is abusing the country´s right to sovereignty to the maximum. It is no surprise. Every dishonest, characterless, criminal and unpatriotic person in the Venezuelan government would do it. What makes the Bs 6.3 = 1 USD rate possible? Sovereignty. Since their control over the market in USD in Venezuela is almost complete and the opposition is impotent, they can keep the money for nothing arbitrage between 6.3 and 170 going for as long as they maintain the status quo. Currently there is no end in sight.

February 13, 2015 at 10:44 am

Island, I want someone else to try their Canadian or USD credit card and report back…..before I use one of my and end up either paying $0.50 or $13 for a Bs80 cup of coffee. My level of trust in these thieves who call themselves a government is so low (non-existent in fact) that I am not willing to try until it is proven to me.

February 13, 2015 at 12:30 pm

I will try later next week once Carnaval is over so that they have time to make the adjustments.

I’ll report back here.

February 13, 2015 at 1:09 pm

I’ll be very curious about the result. I haven’t used a foreign card here in rojo rojoitaland for over ten years ever since I was forced to late one night back in 2004 when checking in to the Eurobuilding hotel at Maiquetia and I had no Bs and no one would change any for me. The company accountant called me and asked what hotel in Venezuela was worth over $400 a night.

February 13, 2015 at 2:22 pm

please let us know Island Canuck, I am also interested in using my capital one rather than bringing around cash with me, at this price, at least for the next 2 weeks, should seem to be better than dealing with the black market… (I should be in venezuela sometime next week, and was thinking of bringing cash, (not even sure how much I really need) but with the price at 170, that seems to be at least…. reasonable..) (Although I have no idea how much things are in the calle, havent been to venezuela for almost 2 years)

February 14, 2015 at 2:19 pm

Hmmm… Better call your bank first and ask.

February 15, 2015 at 7:06 am

I have a “punto de venta”.

I’ll pass my card for a small amount, say Bs.100, & see what happens.

After Carnavales.

February 13, 2015 at 8:59 am

I cannot believe that they officialized it at 170, these bastards are going to make a killing with the dollar arbitrage.

We are on our way to hyperinflation and the dollarization of the economy. I hope this puts on our way quicker to the end of this gangster model.

February 13, 2015 at 8:03 am

Good explanation.

The complexity and vagueness allows the government to avoid the situation being defined as a devaluation. With an exchange of 170 USD min. wage drops to $33 per month.

Mérida, Mérida Venezuela

February 13, 2015 at 3:35 am

As if DFI wasn’t scare as is….this will certainly help*.

*Y’all can imagine the eyeroll.

February 12, 2015 at 8:52 pm

Do I understand this correctly? – if you use a foreign credit card in Venezuela henceforth, the SIMADI rate will apply?

February 12, 2015 at 8:53 pm

Yes!

February 12, 2015 at 10:35 pm

well at least they did one thing right …

February 12, 2015 at 10:58 pm

When you do everything the wrong, you are bound to make mistakes.

February 13, 2015 at 1:53 am

Excellent Miguel

February 13, 2015 at 3:35 am

And this will surely help tourism. Where’s Izarra to spin this happily?

February 13, 2015 at 6:45 am

Tourism will be greatly helped.

Now tourists don’t have to bring large amounts of cash & will be able to freely trade in exchange houses.

Now all they have to do is make it easier for foreign tourists to get to places like Isla Margarita with direct flights.

February 14, 2015 at 5:08 am

I think tourism will be advantaged in the short term, but the long term effects of the 170+ rate (174 last I saw, and by the time it goes into full effect, I firmly believe it will be close to 200), from about 6 months out on, it will be like dumping gasoline on a fire with regards to inflation.

The problem with tourism is that it is usually planned a few months in advance and hits that lag effect rather nicely. If they keep their word and “float” the bolivar at market rates, it will be somewhat okay, although it will still punish folks like yourself that usually take bookings in advance; this will be more difficult as the rate of inflation accelerates.

Bear in mind that from what I have seen, the dilutive effects of the mass printing of new bills at La Placera has been slowed somewhat by distribution since it seems a lot of the bolivars go back and forth to state entities and funding locally for PDVSA with eventual filtration down into the daily transactions that really drive inflation. In my opinion, this is why inflation is actually less than it could/should be at this point given the expansion of the money supply; the lagging just delays it, but doesn’t stop it. This new mechanism is opening up a more direct spigot into the general economy and should accelerate the speed of money in the mid-term.

I do agree with you that it will be fabulous for people with foreign based accounts. Unfortunately, that won’t help a large portion of the population that lacks access to those banking systems. (Prediction: explosive banking activity in Cucuta/Aruba/Curacao etc.). Also, imagine the compounding effect on inflation when folks with dollars/CDollars/euros/francs suddenly can pull out 60000 bolos for a $300 transaction each day for nearly a week.

This is, of course, for bolivars being bought for transactional purposes. It is also quite probable that the buy side of foreign currency will offset this, draining millions (billions?) of bolivars out of the system. But that I am quite skeptical of; not from a demand viewpoint, but a supply viewpoint on the part of the government. They can sell unlimited bolivars, but they may not be able to sell unlimited dollars…

February 14, 2015 at 10:24 am

Excellent analysis. To add even more gasoline to the fire, there is a rumor that they’ve finally decided to raise gasoline prices, and shortly. This outta be good….

February 14, 2015 at 11:46 am

“…although it will still punish folks like yourself that usually take bookings in advance;”

We are only taking reservations in Bs. for 90 days.

Won’t have prices for the summer until after Semana Santa & won’t have prices for Navidad / Fin de Año until late July.

We made the mistake last year of accepting reservations too far ahead & by the time the people arrived they were staying for half price.

We are also noticing a strong downturn in reservations.

It looks to me that there will be a recession due to the difference in salaries & current costs. It’s super expensive for a Venezuelan family to visit Margarita these days.

Of course for foreigners right now it’s a super cheap option.

February 15, 2015 at 6:42 pm

And then there’s the crime rate. I wouldn’t send Conan and Serpico to visit anywhere in Venezuela.

February 13, 2015 at 9:32 am

This is also a great help to those of us who live here.

It takes away the stress of having to negotiate exchange rates in the black market.

Now we can use our foreign based credit / debit cards in ATMs or stores to pay for things at the Bs.170 rate. Solves all sorts of problems & headaches.

Also keeps the flow od Bs. through our accounts down to a reasonable level.

February 12, 2015 at 8:39 pm

This is not complex. This is not Marxism. This is one big fat joke. More people will become more rich and to hell with the populace.

February 12, 2015 at 8:48 pm

Glenn, right you are, to hell with the populace, they bloody well deserve their predicament. That is a well deserved reward for backing up an eternal galactic turd.

February 14, 2015 at 1:22 am

It is certainly not Marxist nor even socialism. Venezuela is a kleptocracy of the PSUV for PSUV by the PSUV. Ecuador and Bolivia have like-minded governments and have far different outcomes. Ask yourself why?

February 12, 2015 at 8:35 pm

It seems to me that, besides the desire to control everything, this new fx system is designed to minimize the volume of transactions; after all, the governement must realize that it is the only likely seller of dollars in large amounts while individuals and private parties will likely want to be net buyers of dollars.

February 13, 2015 at 4:40 am

Noel, I think they expect foreign investors to pile in, buy bolivars at 170 to pay for the goods and services they receive in Venezuela. In their minds, this could apply to hotel chains, computer and electric appliance factories, and agribusiness. This will cause an economic boom and “re power the economy” and the “revolution” will defeat imperialist aggression. Eh?

February 12, 2015 at 8:29 pm

But dollar today rose to Bs. 190.75

February 15, 2015 at 7:36 am

Last time I checked simadi closed almost 175

And last time I checked in the black market (dólar paralelo) the price is at 177 I think we just have to see in a couple of weeks what happens

Also dolartoday is not the only place to see the price which if u see they also have a price at 168

Just search around dólar paralelo in Google several site give the price

I’ll say the best site will be http://www.valzu.com as it removes all the BS from dolartoday

February 15, 2015 at 9:21 am

Dolartoday is at 187.5

February 12, 2015 at 8:27 pm

at 170 per 1 US dollar !!!